March is here and with it comes some Madness! This week on the LPL Market Signals podcast, Chief Market Strategist Ryan Detrick and Equity Strategist Jeff Buchbinder discuss four things that matter the most for stocks in 2021.

Rates and Profits

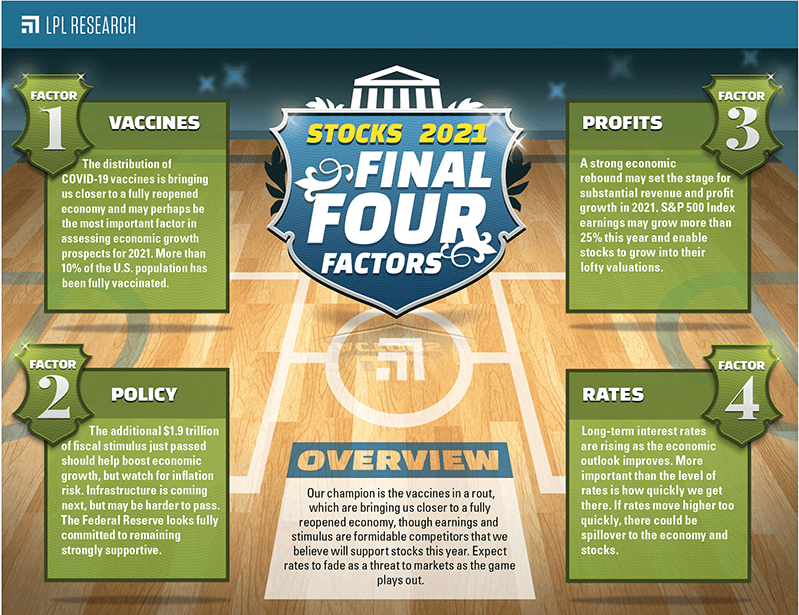

The #4 and #3 factors that matter to stocks are rates and profits. Long-term rates have been rising on expectations of a better economy. Higher rates can impact bond prices, so money could be leaving bonds and into stocks should rates continue to move higher. Ryan and Jeff note that profits are the life blood to any strong economic recovery and with S&P 500 Index earnings expected to jump 25% in ’21, the stage is set for profits to justify the record run.

Policy and Vaccines

Policy is the #2 factor that matter to stocks, while vaccines are our #1 factor. Turning to policy, record monetary and fiscal policy are a big part of why stocks are so strong and will continue to be strong. The Federal Reserve (Fed) is fully committed to lower rates, while a huge stimulus bill is coming later this year. Ryan and Jeff agree, though, that the #1 factor is vaccines. With more than 10% of the United States vaccinated, and millions more set to receive a vaccine every day, the reopening is happening faster than nearly anyone had expected.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth in the podcast may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. All indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index data is from FactSet.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Member FINRA/SIPC