Real-time data shows some positive news regarding COVID-19 trends. Small cap stocks are coming off a huge surge and show promise for continued outperformance in 2021. Stock valuations are also in the news, for several reasons.

Positive COVID-19 trends in real-time data

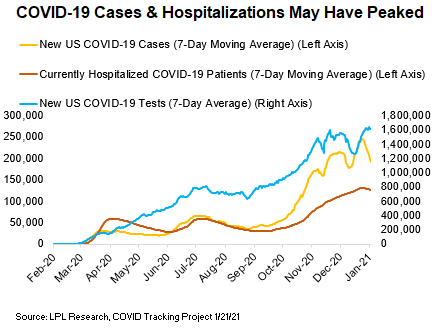

With the surge in COVID-19 cases around the holidays beginning to slow down, there are some positive data trends regarding the pandemic. The number of new daily cases in the United States (7-day average) has turned lower and may have peaked, while the number of patients hospitalized is rounding lower as well. As more vaccines are administered each day, we are inching closer to more reopenings and a fully functioning economy.

We still like small cap stocks

Small cap stocks have had a historic move over the last several months, and near-term a pause makes sense now, but we still like the group. A new economic expansion may help small caps perform significantly better than their large cap brothers. Additionally, earnings are exploding higher for small caps, justifying the recent move higher.

Stock valuations

One concern is that stock valuations are quite high in the United States and Europe, but emerging markets are still quite cheap and that’s where the growth is taking place. Japan’s stocks are quite cheap as well, with some improving fundamentals.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth in the podcast may not develop as predicted and are subject to change.

The prices of small and mid-cap stocks are generally more volatile than large cap stocks.

Investing in foreign and emerging markets securities involves special additional risks. These risks include, but are not limited to, currency risk, geopolitical risk, and risk associated with varying accounting standards. Investing in emerging markets may accentuate these risks.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. All indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities. All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All index data is from FactSet.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

This Research material was prepared by LPL Financial, LLC.

Member FINRA/SIPC