Markets have adjusted to several changes this year. The pace at which inflation has cooled is slowing. The market has started to believe the Federal Reserve’s (Fed) “higher for longer” message. The bar for earnings has been lowered. Market relationships to interest rates have been turned upside down. And many of last year’s losers are this year’s winners, and vice versa. Here we take a look at some of the biggest changes in the market environment so far in 2023 and what those changes could mean for investors over the balance of the year.

The Fed’s Message Is Getting Through As Markets Recalibrate

Coming into 2023, markets had been pricing in two 25 basis point (0.25%) interest rate hikes, one in February and the second one at the next Fed meeting on March 21-22. In addition, there were expectations of an interest rate cut at the end of the year. All macro-economic indications suggested that with inflationary pressures easing, the Fed would be moving closer to its final “terminal” rate by the second half of the year. The only question was would the Fed stay on hold throughout 2023 before lowering rates in 2024, as suggested by a consensus of Fed members.

However, recent data releases, including the Consumer Price Index (CPI), Producer Price Index (PPI), and retail sales, showed inflation inching higher and a consumer still spending at a healthy pace. Even amid weak housing data for January, homebuilder sentiment improved nicely and exceeded expectations. Factoring in all of the data releases, including disappointing industrial production figures, the Atlanta Fed’s GDPNow real-time tracker of gross domestic product inched higher to a solid 2.5% for the first quarter.

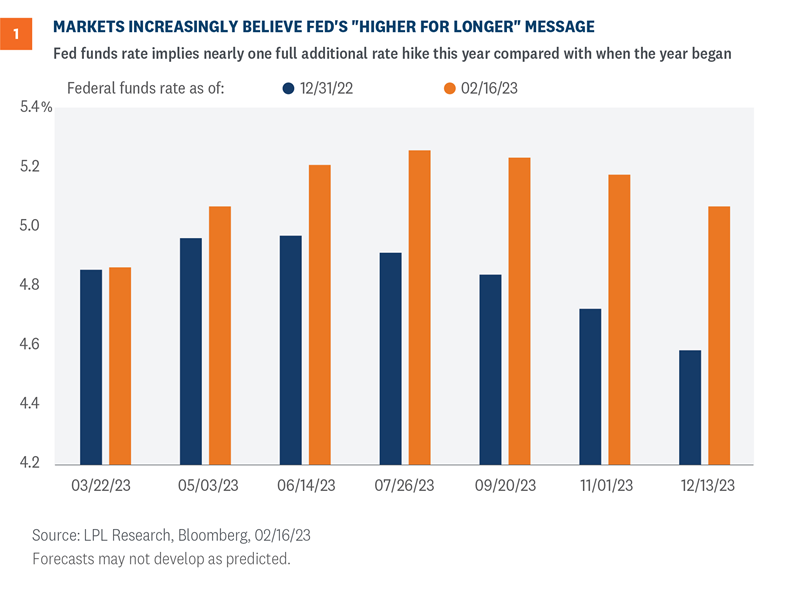

The fed funds futures market quickly adjusted probabilities as well, pricing in a potential third interest rate hike at the Fed’s June meeting. What has caught the market’s attention, however, is the slight probability for a 50 basis point rate hike at the March meeting has been climbing higher, as two non-voting members of the Federal Open Market Committee (FOMC), Loretta Mester and James Bullard, made comments suggesting a 50 basis point rate hike in March may be necessary to help tackle inflation. Markets are listening, which you can clearly see in the change in market-implied Fed rate targets for this year (Figure 1).

Important data releases before the March 21-22 meeting will help underpin the Fed’s monetary policy trajectory. The February 24 release of the Fed’s preferred inflation index, the Personal Consumption Expenditures Price Index (PCE), will be especially important in forecasting the Fed’s next policy decision.

Similarly, comments from Fed officials will also help guide markets regarding the Fed’s thinking regarding its rate hike campaign.

Earnings Bar Has Been Lowered Substantially

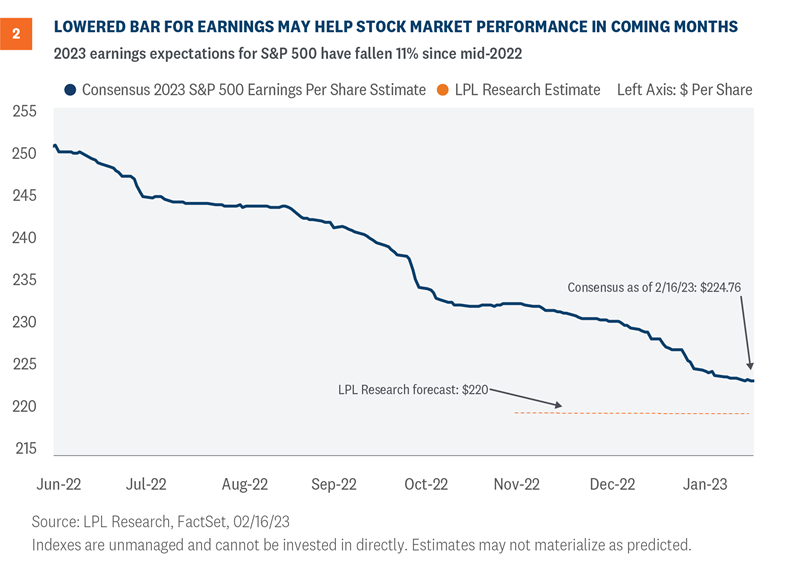

A difficult fourth-quarter earnings season is entering the home stretch, and overall the numbers have been lackluster. S&P 500 earnings per share (EPS) for the quarter are tracking to a roughly 4% year-over-year decline, slightly below estimates at year-end. Slower economic growth, cost pressures from higher inflation, and ongoing adjustments from excess pandemic-related spending have combined to create an especially challenging earnings environment. The end result will be the first year-over-year earnings decline since the third quarter of 2020.

Despite lackluster overall results, we see a silver lining amid the sea of red numbers. Earnings estimates for 2023 have been widely considered to be too high based on historical earnings declines in recessions. The consensus estimate for S&P 500 earnings this year has come down 3% since the year began, lowering the bar. Earnings estimates have not collapsed, but corporate America has sure brought expectations down (Figure 2). Cautious guidance has made estimates more realistic.

It’s difficult for stocks to sustain moves higher as estimates are coming down. However, we believe lowering the bar sets up potential gains for stocks later this year as estimates stabilize, or potentially even start moving higher, and earnings growth resumes.

Shifting Relationship Between Stocks and Interest Rates

Much has been written about how the laggards of 2022 have been the winners of 2023. Value stocks held up much better than growth stocks last year, and this year growth is leading. Last year’s worst-performing sectors, consumer discretionary, communication services, and technology, are this year’s top performers, each with double-digit year-to-date-percentage gains. At the individual stock level, the reversal is stark. The 50 worst-performing stocks of 2022 have gained an average of 21.8% year to date.

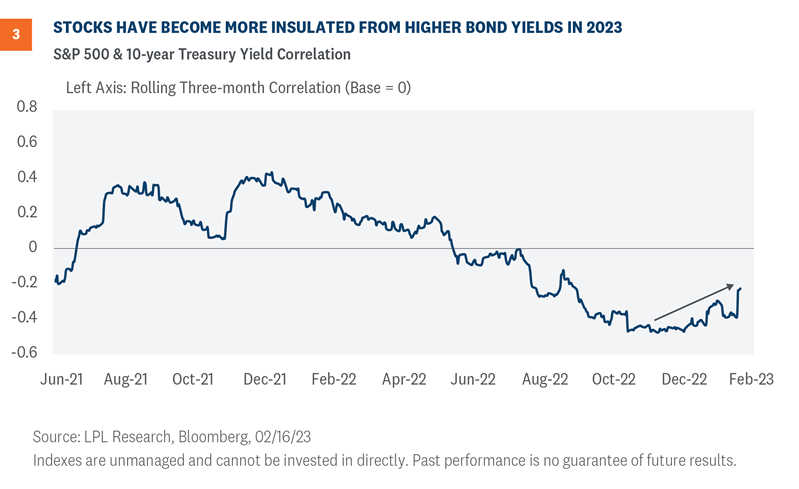

Here we focus on the interest rate relationship. Last year, stocks and yields moved mostly in opposite directions. When inflation expectations and interest rates moved higher, stocks tended to sell off and vice versa. But we have seen this relationship change recently, as stocks and yields have risen together. Specifically, since January 25, the 10-year Treasury yield has risen roughly 50 basis points while the S&P 500 has gained 2%. That’s not much, but as Figure 3 shows, it suggests a more resilient equity market in the face of higher-than-expected inflation data. Last year, the market response to pricing in more Fed rate hikes would have been much more negative.

We don’t know if this dynamic will be sustained, but we view it as a positive step toward exiting the bear market that increases the chances of a rewarding 2023 for investors.

What does it mean?

We see several implications from these changes in the economic and market environment:

- More volatility in the near term. First, though this may be obvious, markets may be bumpy in the coming weeks and months because it will take more time to fully price in the end of the Fed rate hiking cycle. Market-based interest rates, such as the 10-year Treasury, may go higher than we anticipated when the year began, potentially putting pressure on stock valuations. That makes our bull case for stocks (S&P 500 to 5,100) in Outlook 2023: Finding Balance less likely than our original odds of 25% and increases the chances that stocks miss our base case scenario target (4,320) from that publication.

- Possible barbell year. The lowered bar for earnings should help stocks over the balance of the year, though that benefit may not come until the fall. We could envision a scenario where estimates dip below our forecast before upside late in the year gives earnings—and stock prices—a lift. That means we could see a solid start for stocks and a solid finish, with weakness in between.

- Don’t chase high growth. We would be careful not to chase the most growth-oriented sectors of the market after such a strong start to the year. Near-term risk of higher interest rates is increasing, and these areas do tend to be interest rate sensitive. Value-style stocks are trading at well above-average valuation discounts to their growth counterparts despite the strong 2022 and have historically performed better in inflationary, higher interest rate environments. Energy and industrials look like particularly fertile ground to find investment opportunities.

In conclusion, while these takeaways may not sound particularly bullish at the moment, we would not discount the chances of a soft landing (as we wrote about here last week). The elevated producer price index (PPI) reading last week was disappointing, but it was paired with a solid retail sales report and low jobless claims numbers that tell us the outlook for consumer spending remains healthy. The path to low double-digit gains for stocks this year has narrowed some, but it still looks passable.

Jeffrey Buchbinder, CFA, Chief Equity Strategist, LPL Financial

Quincy Krosby, PhD, Chief Global Strategist, LPL Financial

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

All investing involves risk, including possible loss of principal.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

All index data from Bloomberg.

For a list of descriptions of the indexes and economic terms referenced in this publication, please visit our website at lplresearch.com/definitions.

This research material has been prepared by LPL Financial LLC.

Securities and advisory services offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. To the extent you are receiving investment advice from a separately registered independent investment advisor that is not an LPL affiliate, please note LPL makes no representation with respect to such entity.

| Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Guaranteed | Not Bank/Credit Union Deposits or Obligations | May Lose Value |